How to do Futures Trading on HTX

In this comprehensive guide, we will walk you through the fundamentals of futures trading on HTX, covering key concepts, essential terminology, and step-by-step instructions to help both beginners and experienced traders navigate this exciting market.

What are Perpetual Futures Contracts?

A futures contract is a legally binding agreement between two parties to buy or sell an asset at a predetermined price and date in the future. These assets can vary from commodities like gold or oil to financial instruments such as cryptocurrencies or stocks. This type of contract serves as a versatile tool for both hedging against potential losses and securing profits.

Perpetual futures contracts, a subtype of derivatives, enable traders to speculate on the future price of an underlying asset without actually owning it. Unlike regular futures contracts with set expiration dates, perpetual futures contracts do not expire. Traders can maintain their positions for as long as they desire, allowing them to capitalize on long-term market trends and potentially earn substantial profits. Additionally, perpetual futures contracts often feature unique elements like funding rates, which help align their price with the underlying asset.

One distinctive aspect of perpetual futures is the absence of settlement periods. Traders can keep a position open for as long as they have sufficient margin, without being bound by any contract expiry time. For instance, if you purchase a BTC/USDT perpetual contract at $60,000 there is no obligation to close the trade by a specific date. You have the flexibility to secure your profit or cut losses at your discretion. It’s worth noting that trading perpetual futures is not allowed in the U.S., although it constitutes a substantial portion of global cryptocurrency trading.

While perpetual futures contracts offer a valuable tool for gaining exposure to cryptocurrency markets, it’s essential to acknowledge the associated risks and exercise caution when engaging in such trading activities.

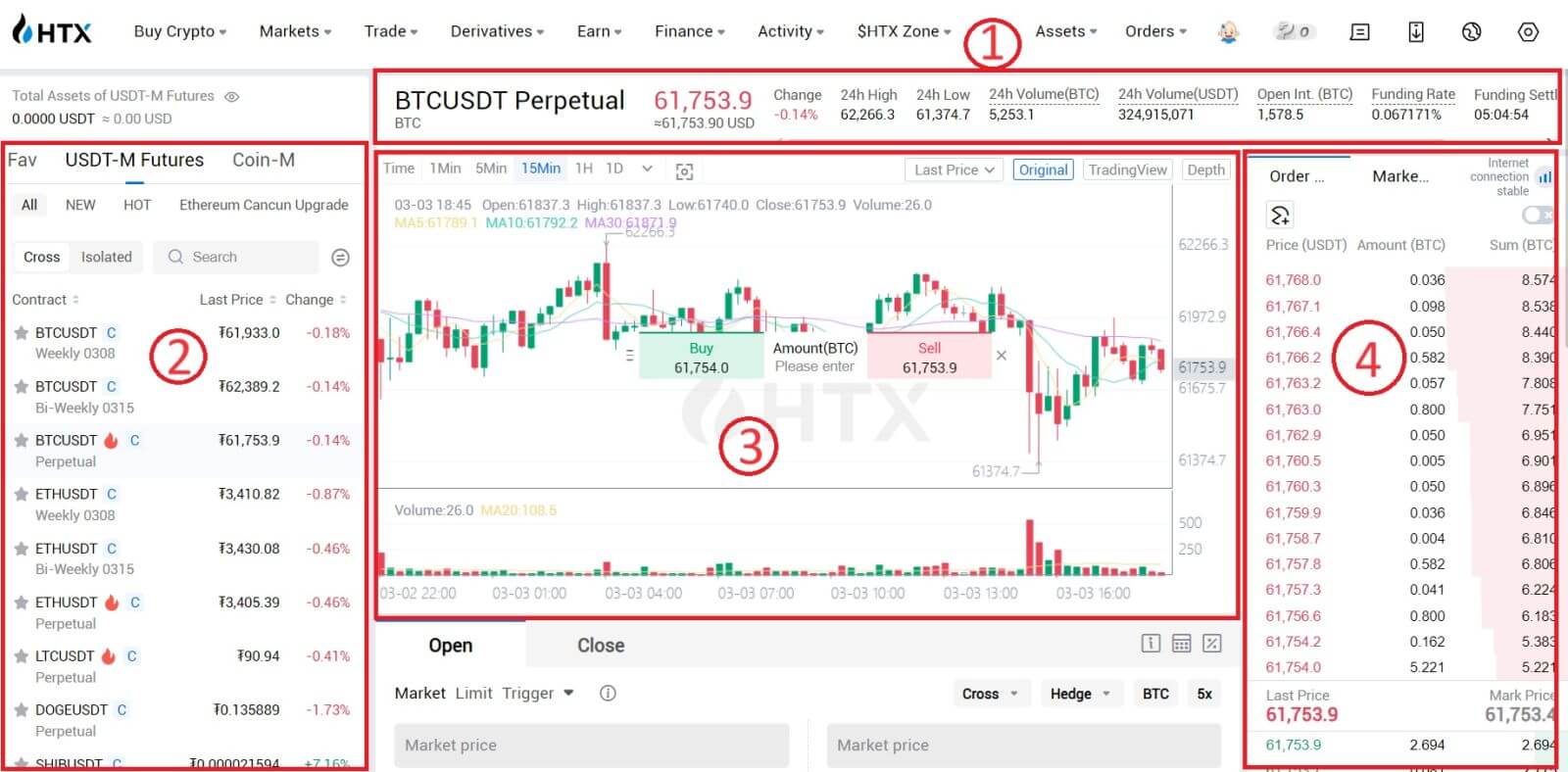

Explanation of Terminology on the Futures Trading Page on HTX

For beginners, futures trading can be more complex than spot trading, as it involves a greater number of professional terms. To help new users understand and master futures trading effectively, this article aims to explain the meanings of these terms as they appear on the HTX futures trading page.

We will introduce these terms in order of appearance, starting from left to right.

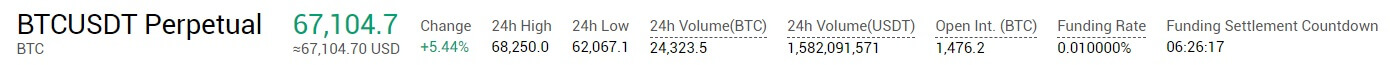

1. Top navigation menu: In this navigational section, you can have quick access to various functions, including futures products, tradingview, markets, information, copy trading, other major functions (such as spot trading), trading management, accounts, messages notifications, trading settings, APP download guides, and language/currency settings.

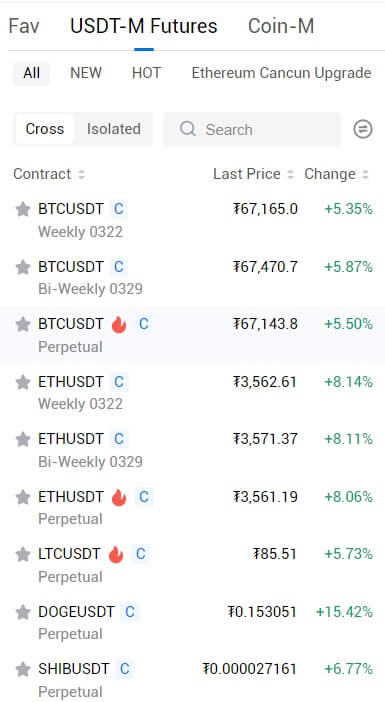

2. Futures Market: Here, you can directly search for the contract you want to trade in the list. What’s more, you can customize your trading page layout. By switching to the old version of the layout, you can view your asset balance in the upper left corner.

3. Chart Sector: The original chart is more suitable for beginners, while the TradingView chart suits professional traders. The TradingView chart allows indicators customization and supports full-screen for a clearer indication of price movements.

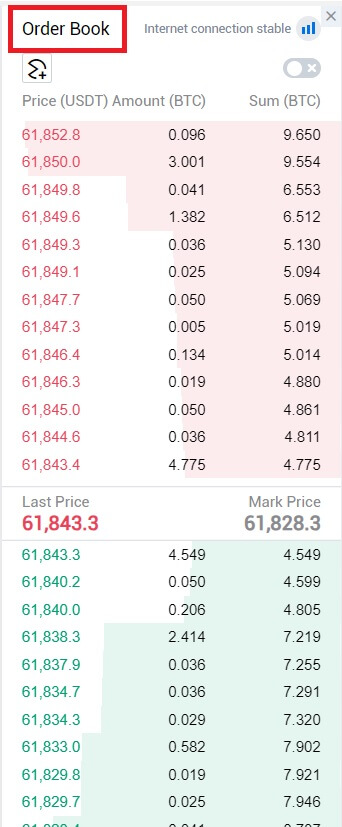

4. Order Book: A window to observe market trends during the trading process. In the order book area, you can observe each trade, the proportion of buyers and sellers, and more.

5. Asset Sector: Here you can have an overview of your asset details.

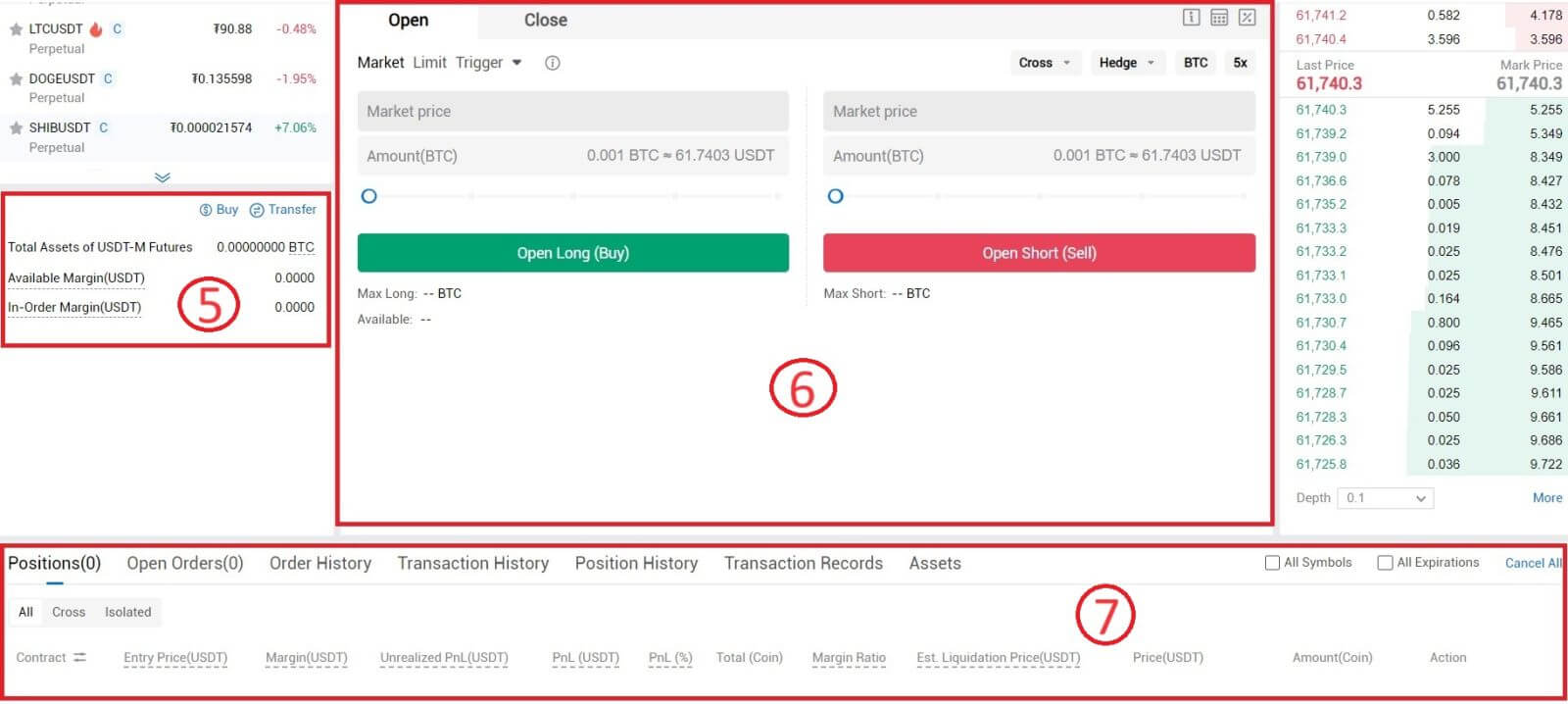

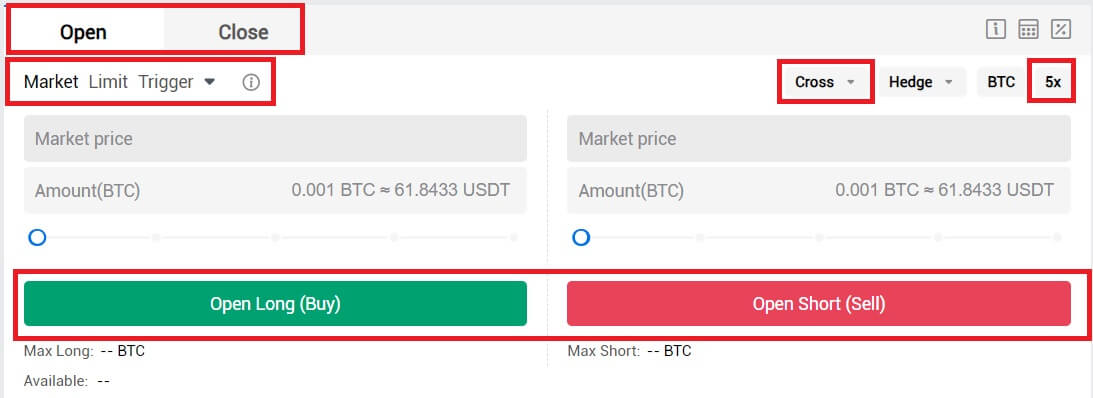

6. Order Sector: Here you can set various order parameters, including price, amount, trading unit, leverage, etc., after selecting the contract you want to trade. Once you are comfortable with your order parameter settings, click the "Open Long/short" button to send your order to the market.

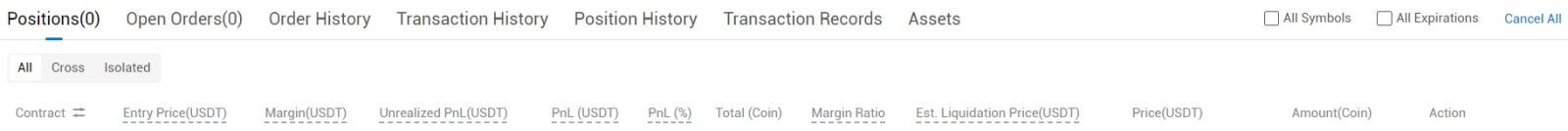

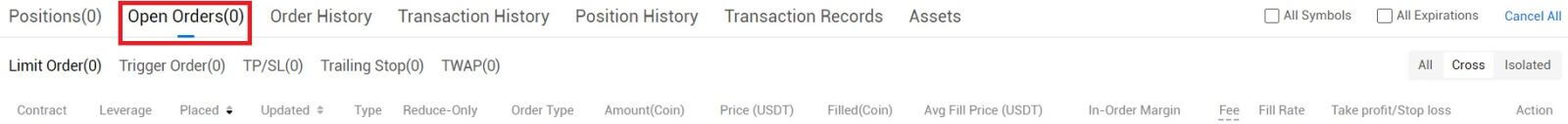

7. Position Sector: After the orders are placed, you can check out the detailed transaction status under the various tabs of Open Orders, Order History, Position History, Assets, etc.

How to Trade USDT-M Perpetual Futures on HTX (Website)

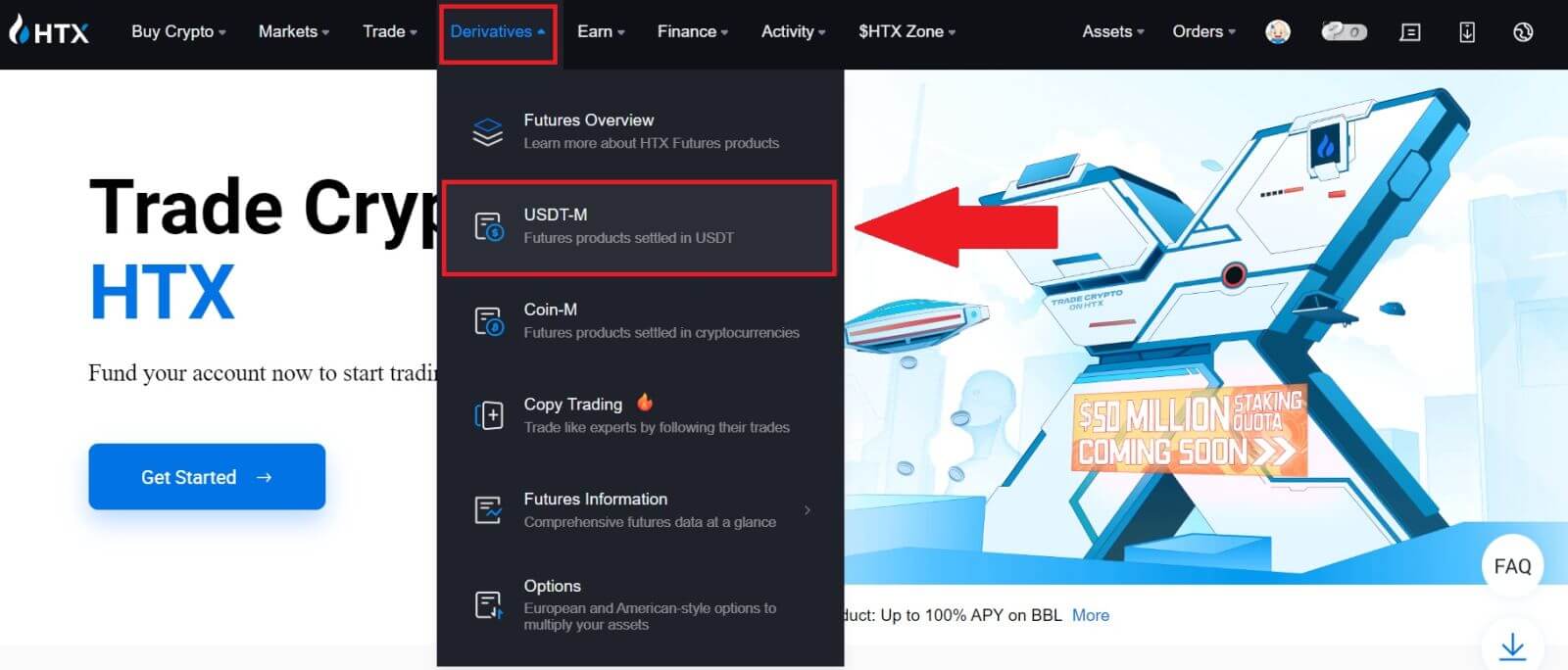

1. Go to the HTX Website, click [Derivatives], and select [USDT-M].

2. On the left-hand side, select BTC/USDT as an example from the list of futures.

3. Click on the following part. Here, you can click on Isolated or Cross to choose your [Margin Mode]. After that, click [Confirm] to save your change.

The platform supports traders with different margin preferences by offering different margin modes.

- The Cross Margin: All cross positions under the same margin asset share the same asset cross margin balance. In the event of liquidation, your assets full margin balance along with any remaining open positions under the asset may be forfeited.

- The Isolated Margin: Manage your risk on individual positions by restricting the amount of margin allocated to each. If the margin ratio of a position reached 100%, the position will be liquidated. Margin can be added or removed to positions using this mode.

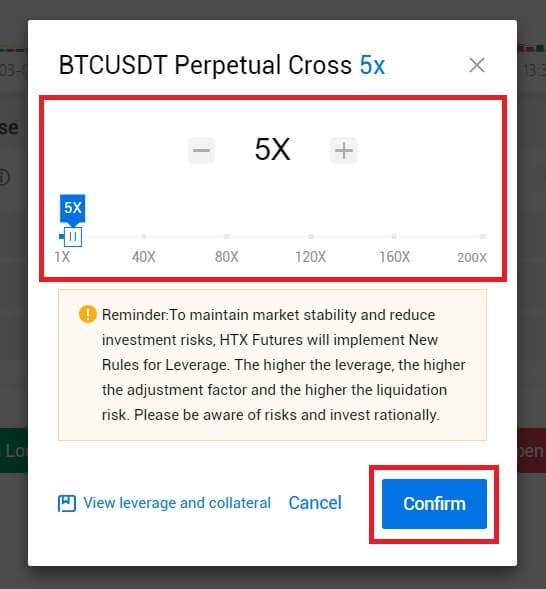

4. Click on the following part, here you can adjust the leverage multiplier by clicking on the number.

After that, click [Confirm] to save your change.

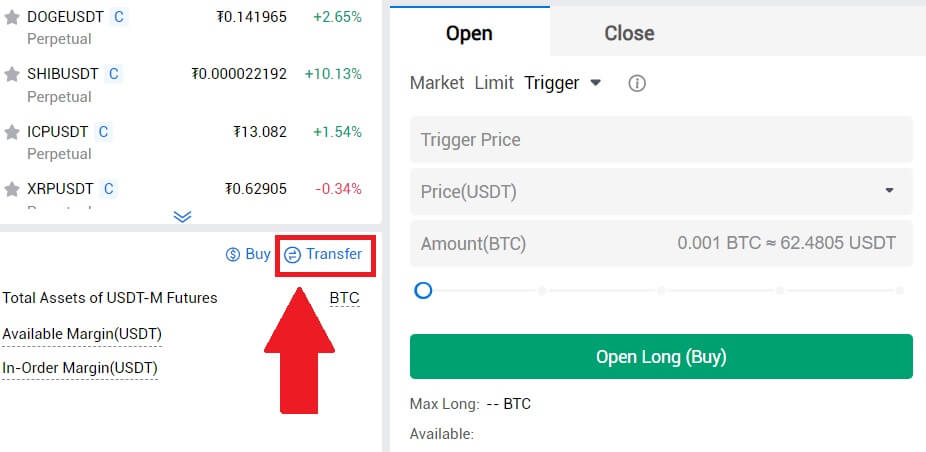

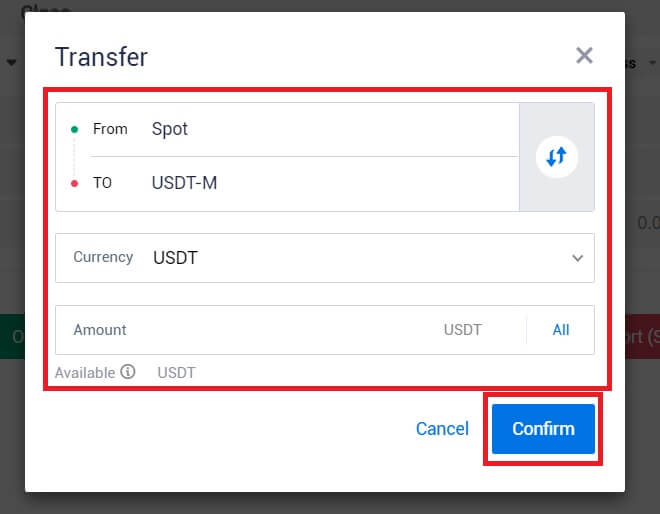

5. To initiate a fund transfer from the spot account to the futures account, click on [Transfer] located on the left of the Trading Area to access the transfer menu.

Once in the transfer menu, enter the desired amount you wish to transfer, and click on [Confirm].

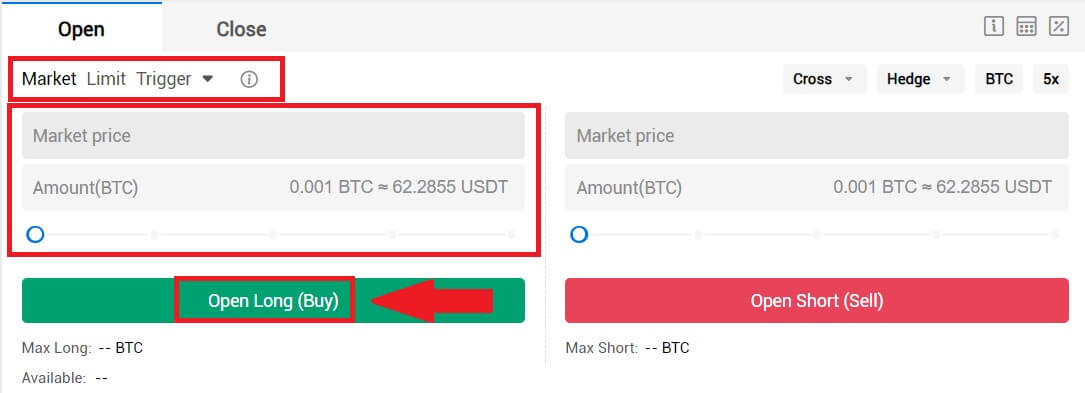

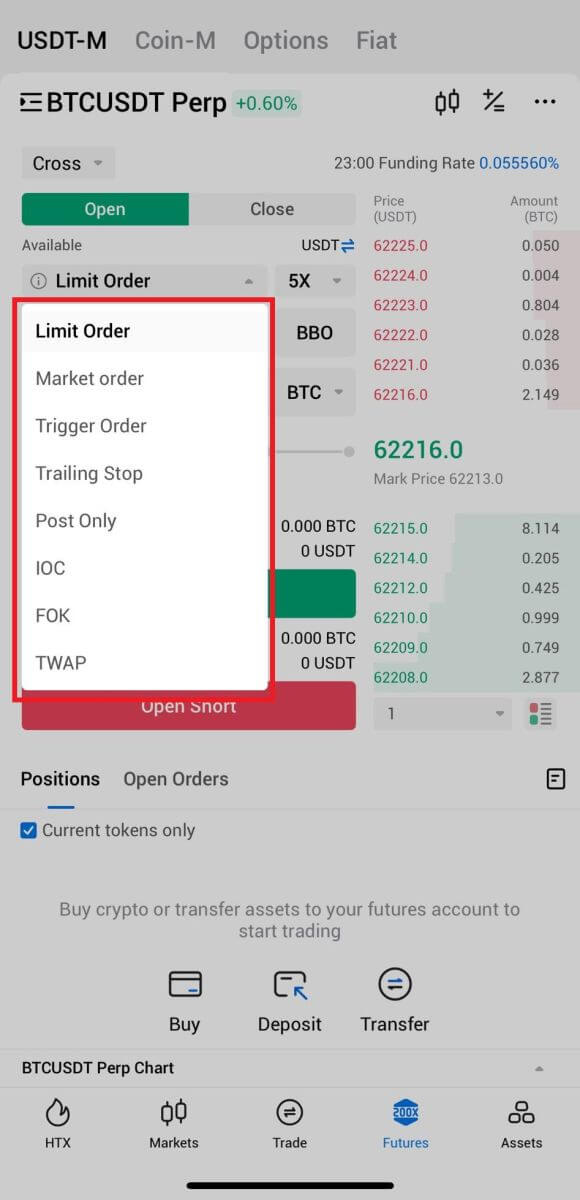

6. To open a position, users have three options: Limit Order, Market Order, and Trigger Order. Follow these steps:

Limit Order:

- Set your preferred buying or selling price.

- The order will only be executed when the market price reaches the specified level.

- If the market price doesn’t reach the set price, the limit order remains in the order book, awaiting execution.

- This option involves a transaction without specifying a buying or selling price.

- The system executes the transaction based on the latest market price when the order is placed.

- Users only need to input the desired order amount.

Trigger Order:

- Set a trigger price, order price, and order quantity.

- The order will only be placed as a limit order with the predetermined price and quantity when the latest market price hits the trigger price.

- This type of order provides users with more control over their trades and helps automate the process based on market conditions.

7. After placing your order, view it under [Open Orders] at the bottom of the page. You can cancel orders before they’re filled.

7. After placing your order, view it under [Open Orders] at the bottom of the page. You can cancel orders before they’re filled.

How to Trade USDT-M Perpetual Futures on HTX (App)

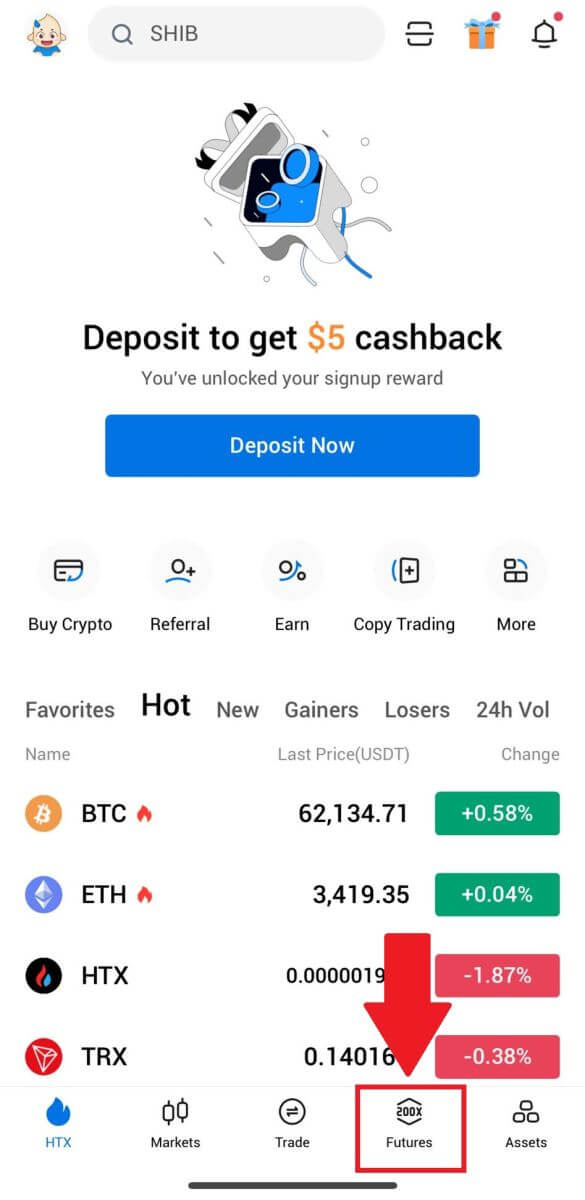

1. Open your HTX App, on the first page, tap on [Futures].

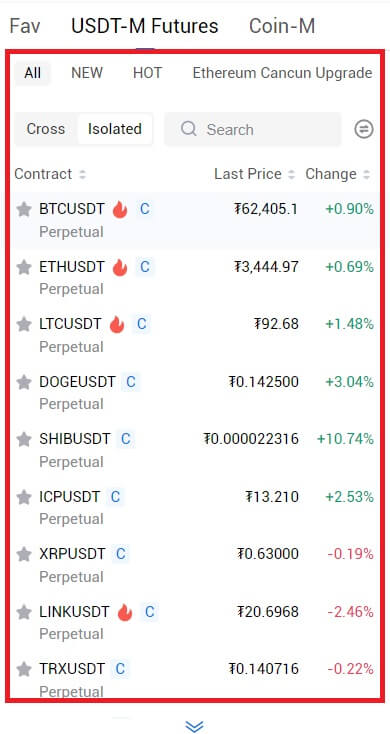

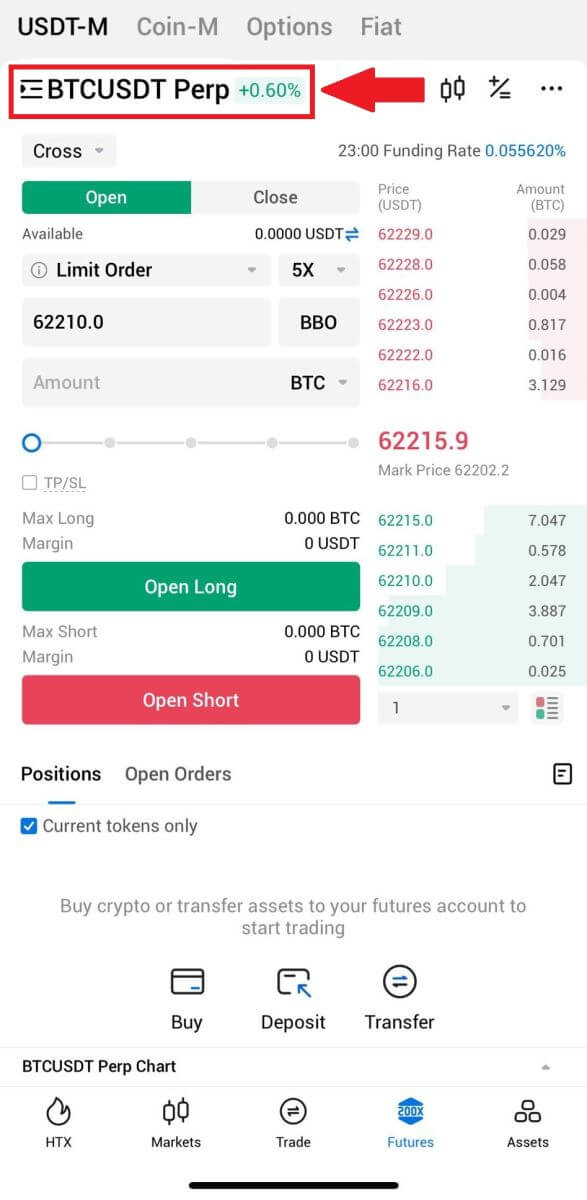

2. To switch between different trading pairs, tap on [BTCUSDT Perp] located at the top left. You can then utilize the search bar for a specific pair or directly select from the listed options to find the desired futures for trading.

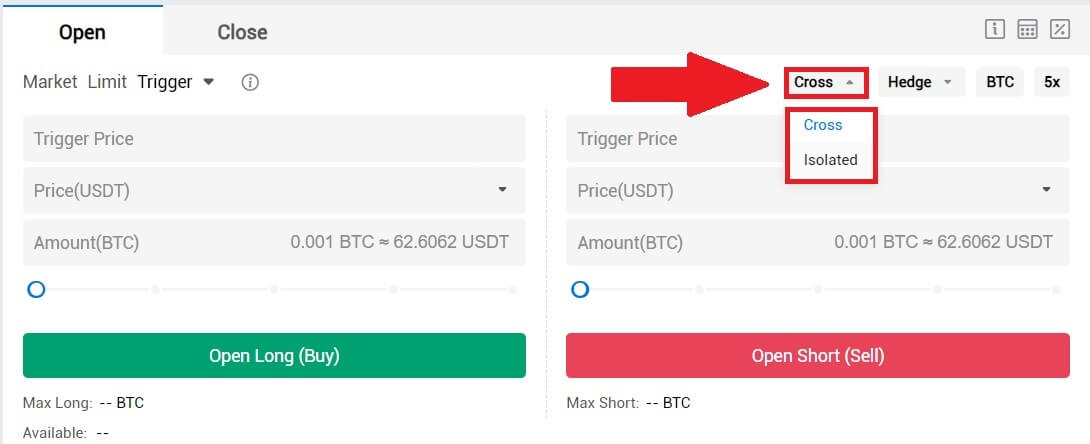

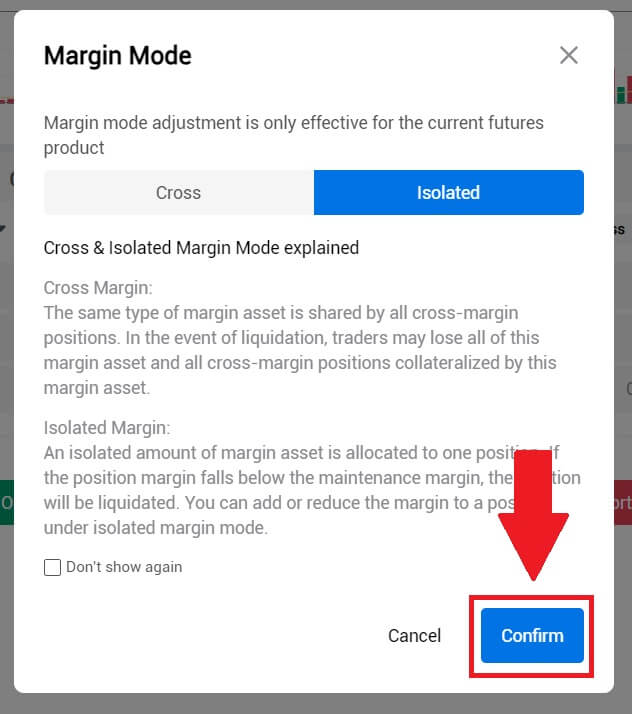

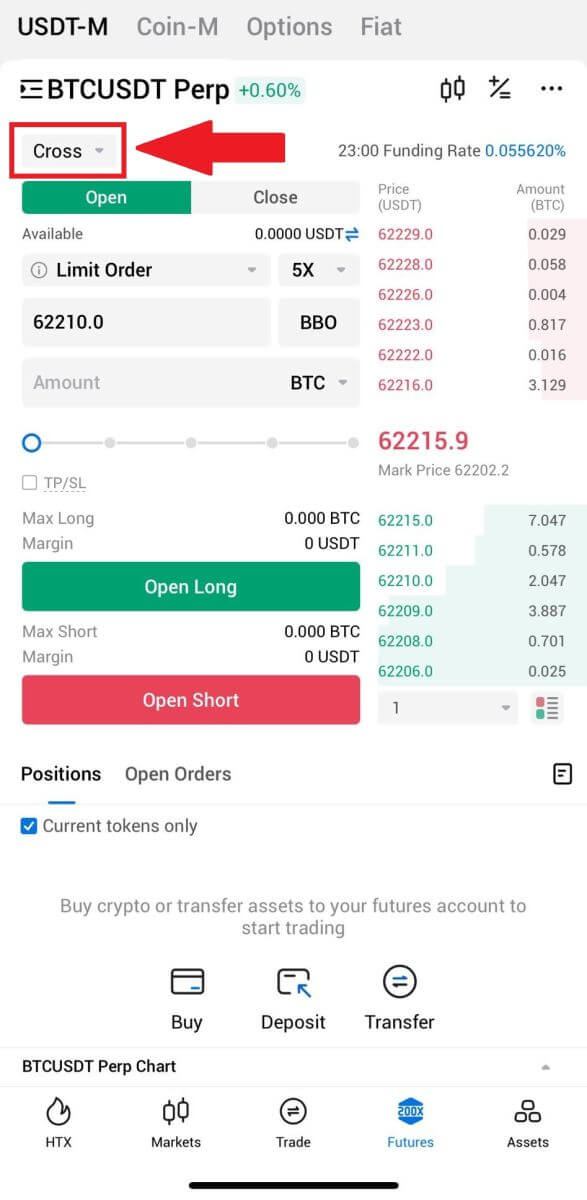

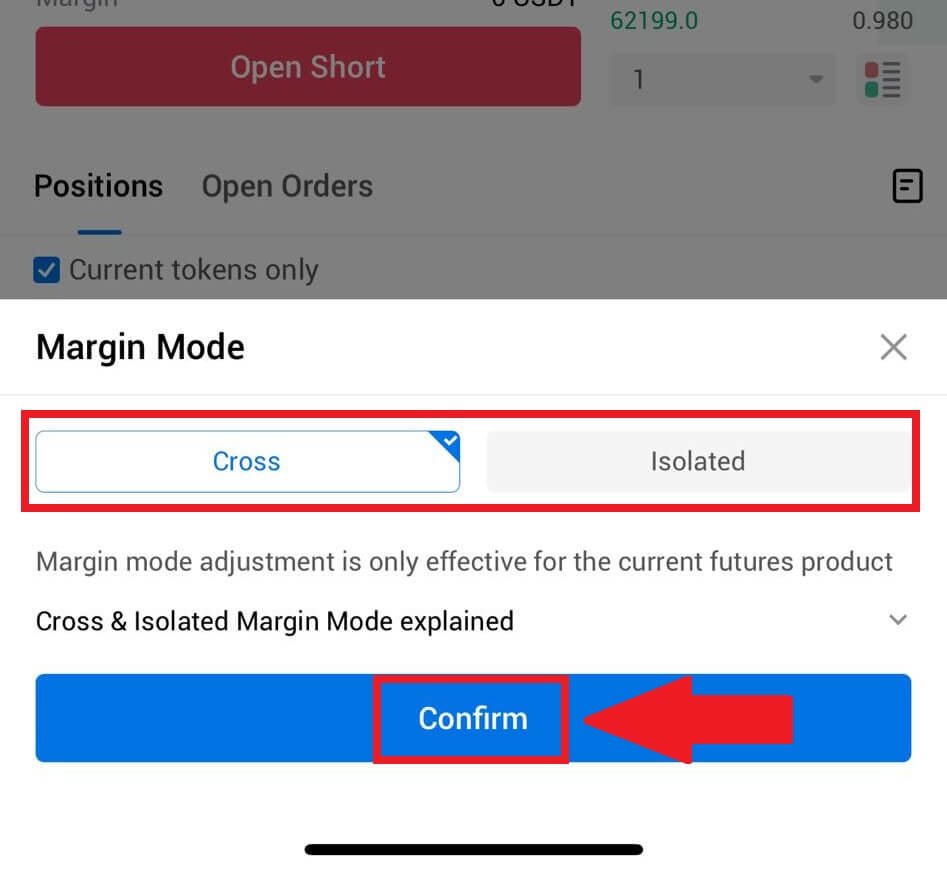

3. Click on the following part. Here, you can click on Isolated or Cross to choose your [Margin Mode]. After that, click [Confirm] to save your change.

The platform supports traders with different margin preferences by offering different margin modes.

- The Cross Margin: All cross positions under the same margin asset share the same asset cross margin balance. In the event of liquidation, your assets full margin balance along with any remaining open positions under the asset may be forfeited.

- The Isolated Margin: Manage your risk on individual positions by restricting the amount of margin allocated to each. If the margin ratio of a position reached 100%, the position will be liquidated. Margin can be added or removed to positions using this mode.

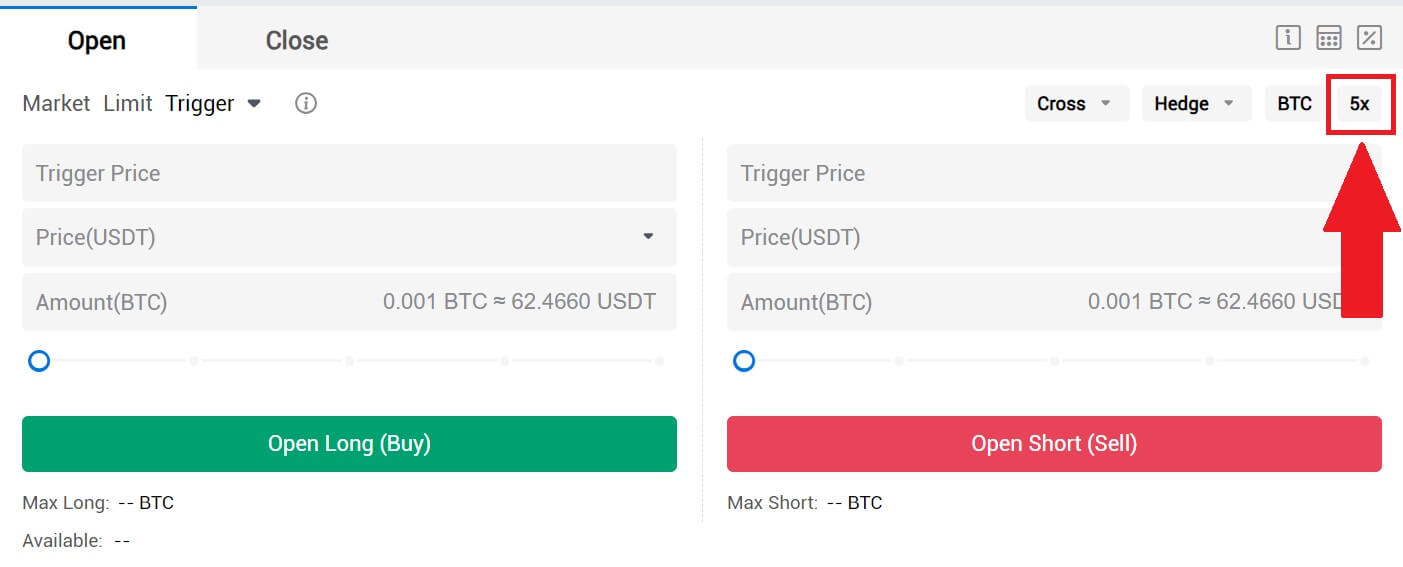

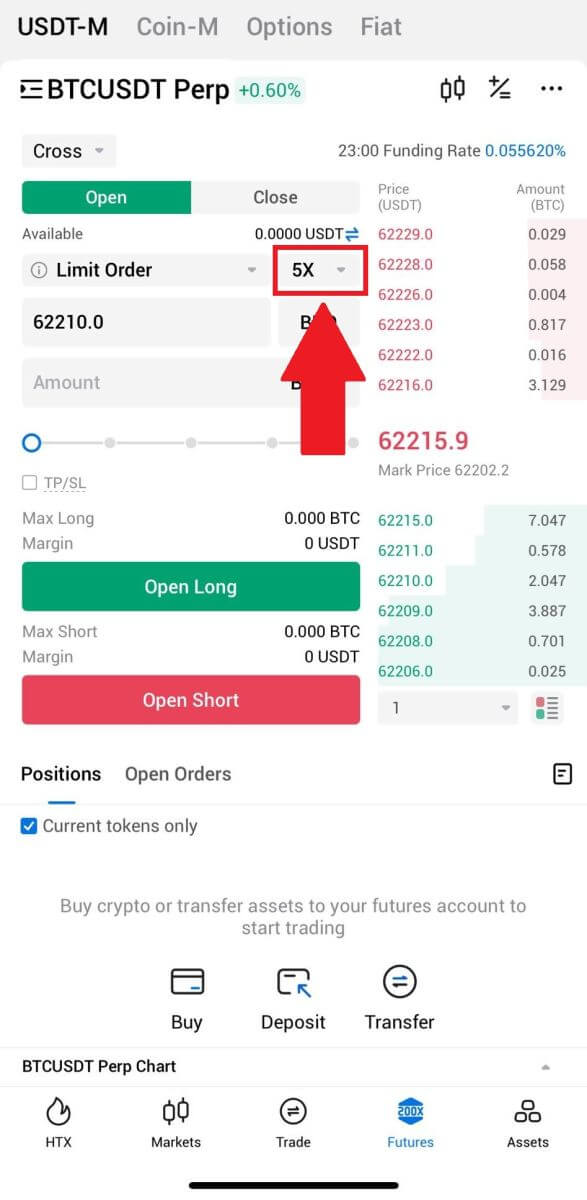

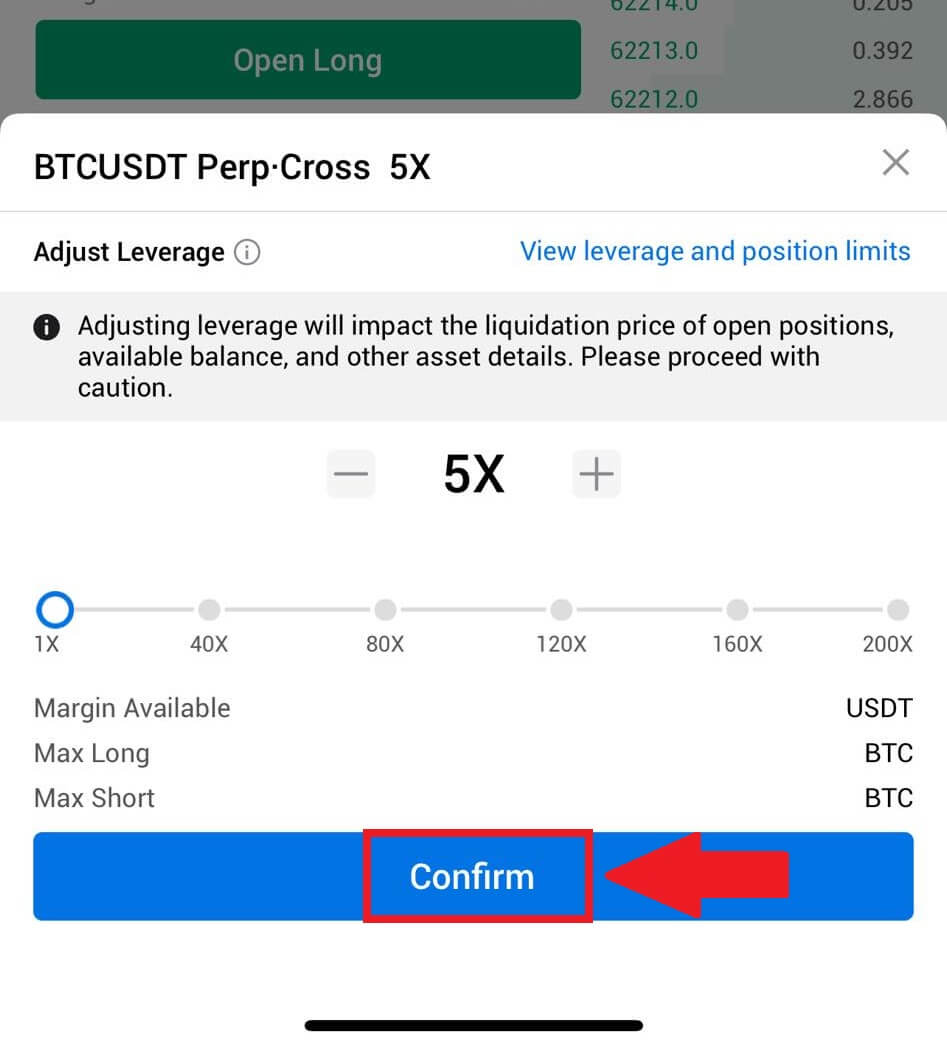

4. Click on the following part, here you can adjust the leverage multiplier by clicking on the number.

After that, click [Confirm] to save your change.

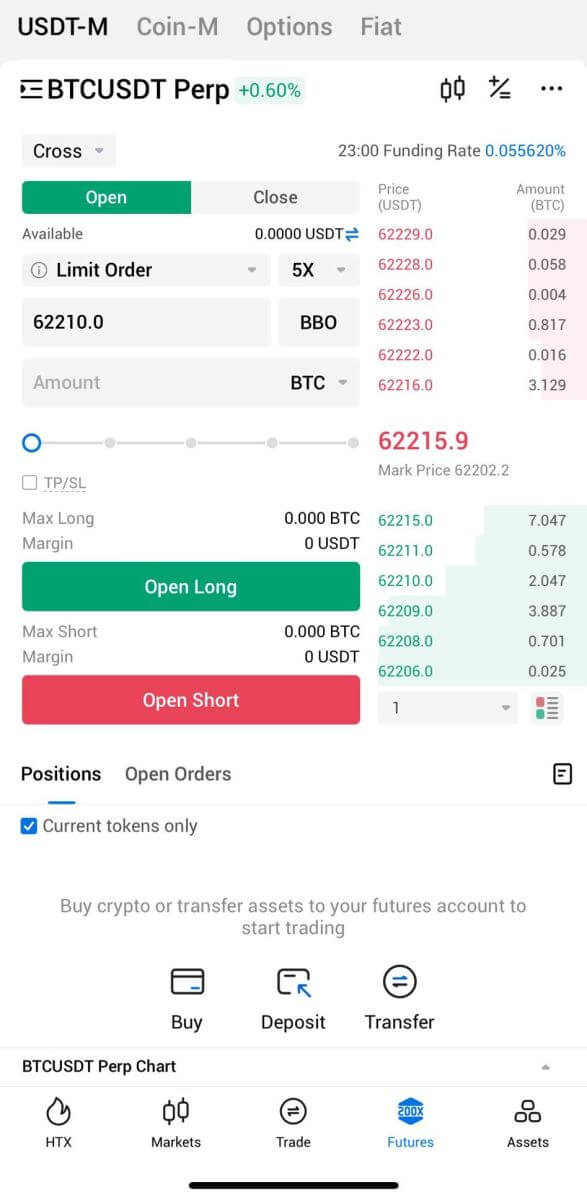

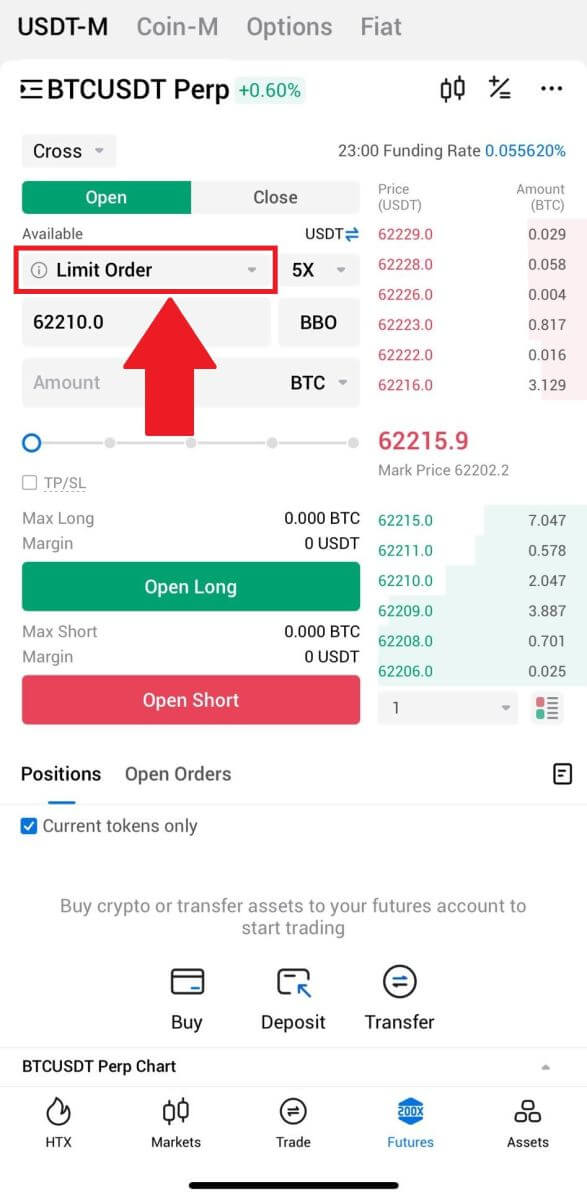

5. Choose your order type by tapping on the following.

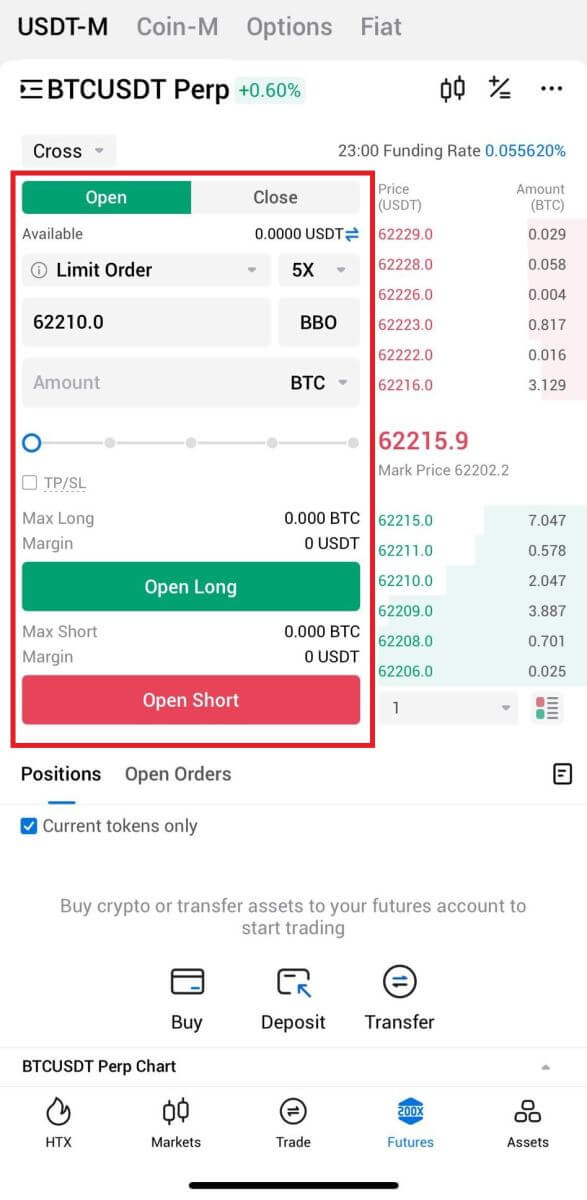

6. On the left side of the screen, place your order. For a limit order, enter the price and amount; for a market order, input only the amount. Tap [Open Long] to initiate a long position, or [Open Short] for a short position.

7. Once the order is placed, if it isn’t filled immediately, it will appear in [Open Orders].

HTX Future Trading Modes

Position Mode

(1) Hedge Mode

- In Hedge Mode, users are required to explicitly indicate whether they intend to open or close a position when placing an order. This mode allows users to hold positions simultaneously in both long and short directions within the same futures contract. The leverages for the long and short positions are independent of each other.

-

All long positions are aggregated, and all short positions are combined within each futures contract. When maintaining positions in both long and short directions, the positions must allocate the corresponding margin based on the specified risk limit level.

For instance, in BTCUSDT futures, users have the flexibility to open a long position with 200x leverage and a short position with 200x leverage concurrently.

(2) One-Way Mode

- In One-Way Mode, users are not required to specify whether they are opening or closing a position when placing an order. Instead, they only need to specify whether they are buying or selling. Additionally, users can only maintain positions in a single direction within each futures contract at any given time. If holding a long position, a sell order will automatically close it once filled. Conversely, if the number of filled sell orders surpasses the number of long positions, a short position will be initiated in the opposite direction.

Margin Modes

(1) Isolated Margin Mode

- In Isolated Margin Mode, the potential loss of a position is limited to the initial margin and any additional position margin used specifically for that isolated position. In the event of liquidation, the user will only incur losses equivalent to the margin associated with the isolated position. The available balance of the account remains untouched and is not utilized as additional margin. Isolating the margin used in a position allows users to restrict losses to the initial margin amount, which can be beneficial in cases where a short-term speculative trading strategy doesn’t pan out.

-

Users can manually inject additional margin into isolated positions to optimize the liquidation price.

(2) Cross-Margin Mode

- Cross Margin Mode involves using the entire available balance of the account as margin to secure all cross positions and prevent liquidation. In this margin mode, if the net asset value falls short of meeting the maintenance margin requirement, liquidation will be triggered. If a cross position undergoes liquidation, the user will lose all assets in the account except for the margin associated with other isolated positions.

Modifying Leverage

- Hedge mode allows users to employ different leverage multipliers for positions in the long and short directions.

- Leverage multipliers can be adjusted within the permitted range of the futures leverage multiplier.

- Hedge mode also permits the switching of margin modes, such as transitioning from isolated mode to cross-margin mode.

Note: If a user has a position in cross-margin mode, it cannot be switched to isolated-margin mode.

Frequently Asked Questions (FAQ)

How do perpetual futures contracts work?

Let’s take a hypothetical example to understand how perpetual futures work. Assume that a trader has some BTC. When they purchase the contract, they either want this sum to increase in line with the price of BTC/USDT or move in the opposite direction when they sell the contract. Considering that each contract is worth $1, if they purchase one contract at the price of $50.50, they must pay $1 in BTC. Instead, if they sell the contract, they get $1’s worth of BTC at the price they sold it for (it still applies if they sell before they acquire).

It is important to note that the trader is purchasing contracts, not BTC or dollars. So, why should you trade crypto perpetual futures? And how can it be certain that the contract’s price will follow the BTC/USDT price?

The answer is via a funding mechanism. Users with long positions are paid the funding rate (compensated by users with short positions) when the contract price is lower than the price of BTC, giving them an incentive to purchase contracts, causing the contract price to rise and realign with the price of BTC/USDT. Similarly, users with short positions can purchase contracts to close their positions, which will likely cause the price of the contract to increase to match the price of BTC.

In contrast to this situation, the opposite occurs when the price of the contract is higher than the price of BTC - i.e., users with long positions pay users with short positions, encouraging sellers to sell the contract, which drives its price closer to the price of BTC. The difference between the contract price and the price of BTC determines how much funding rate one will receive or pay.

What are the differences between perpetual futures contracts and margin trading?

Perpetual futures contracts and margin trading are both ways for traders to increase their exposure to the cryptocurrency markets, but there are some key differences between the two.

- Timeframe: Perpetual futures contracts do not have an expiration date, while margin trading is typically done over a shorter timeframe, with traders borrowing funds to open a position for a specific period of time.

- Settlement: Perpetual futures contracts settle based on the index price of the underlying cryptocurrency, while margin trading settles based on the price of the cryptocurrency at the time the position is closed.

- Leverage: Both perpetual futures contracts and margin trading allow traders to use leverage to increase their exposure to the markets. However, perpetual futures contracts typically offer higher levels of leverage than margin trading, which can increase both potential profits and potential losses.

- Fees: Perpetual futures contracts typically have a funding fee that is paid by traders who hold their positions open for an extended period of time. Margin trading, on the other hand, typically involves paying interest on the borrowed funds.

- Collateral: Perpetual futures contracts require traders to deposit a certain amount of cryptocurrency as collateral to open a position, while margin trading requires traders to deposit funds as collateral.